Author: Courtney Miller – courtney@visualapproach.io

The regional airline business is the least understood segment of the airline industry. It should come as no surprise that the smallest segment of the airline industry would receive the least attention. Small aircraft in small fleets garner limited attention yet place greater importance on experience and expertise. And yet, regional airlines are critically important to the global networks, operating nearly 20% of all departures worldwide.

In partnership with Falko – an aircraft leasing and asset management company with deep expertise in small commercial aircraft – we aim to build this understanding. This is the first of a series of deep dives into the nuances and value of the regional aircraft sector.

Mapping the world’s regional airline business models

(Country of regional fleet by business model, Jan 2025)

The obvious starting point in examining the business of regional airlines is the business model itself – specifically, how revenue is generated. While most passenger airlines rely on tickets and other ancillary revenues from passengers and cargo, regional airlines often differ. We offer three broad categories for regional airline business models:

- Traditional Competitive airlines

- CPA and Large Network airlines

- those considered Essential

Traditional competitive airlines

The revenue model of traditional competitive airlines is simple – passengers buy tickets. Just as with nearly every large airline, traditionally competitive regional airlines compete in the open market, subject to the same risks and rewards. This cohort includes Porter Airlines, China Express, and JSX Airlines, all of which are openly competing in the market with fleets of regional aircraft.

Assuming no more risk than large aircraft business models, the competitive regional airlines have been incorrectly assumed to include a higher risk profile than larger narrowbody and widebody airlines. Even so, the regional aircraft in a competitive airline often works in tandem with larger aircraft, building a complete network that encourages, but is not reliant on connecting traffic.

While the most traditional model for regional airlines in the past was the competitive model today, it represents less than onequarter of the regional market by number of aircraft. The remaining 77% of the fleet operates in a more stable revenue environment than the world’s large aircraft fleet.

CPA / Large network airlines

By far, the largest market segment of regional airlines today is operating in support of a large network airline. Whether under direct ownership or through a Capacity Purchase Agreement (CPA), this cohort of regional airlines operate primarily to provide network connectivity for the major network airline partner.

This connectivity is not offered in a traditional code-share model but rather through cost-plus agreements with the partner airline. This model leaves the business of selling tickets with the larger partner, while the regional carrier focuses on the operation, earning revenue based on completed flights rather than tickets sold.

Inherently, this model places market risk on the large airline while the regional airline secures longstanding agreements. The length of these agreements – typically longer than five years, with some exceeding ten years – separates the CPA model from ACMI. Rather than requiring higher rates for shorter contracts, CPA airlines are able to offer partner airlines competitive rates for long-term agreements.

In short, this model is incredibly stable, often allowing regional airlines to align financing or long-term leases to the term of the CPA. The largest independent regional airlines in the world, including SkyWest Airlines and Republic Airways in the United States, operate under the CPA model. Built primarily for network feed, these subsidiary regional airlines are defined by long-term stability and a risk profile closely linked to the partner airline.

Representing only 17% of regional airlines, most of the world’s regional fleet—over 54%—operates under this uniquely low-risk model. Additionally, the CPA model tends to be countercyclical in nature. While many regional airlines worked closely with their major partners during the COVID-19 pandemic, revenues did not evaporate with passenger demand. The need to maintain network connectivity remained strong for large airlines, cushioning regional airlines through the crisis.

The result is a distinctly stable airline business model compared to others in the industry. While not entirely without risk, the CPA model depends on the regional airline’s ability to operate, leaving it largely protected from the risk of demand events and economic downturns.

Essential services

The smallest cohort of the regional airline fleet is those offering essential services. Although this group presents the fewest number of aircraft, essential services represent the greatest number of airlines.

Routes considered as essential services are those providing the only flight to their destinations. Often owned or directly subsidized by governments, these airlines also tend to be small by nature, focusing on the smallest and least expensive aircraft to maintain service.

While dozens of airlines are focused entirely on aircraft with 19 seats or smaller, we consider only those airlines with aircraft larger than 30 seats in this category for this analysis. Aircraft with up to 80 seats are operating on essential service routes today, reflecting a need for this service despite a dwindling number of small aircraft available to provide it.

Sporting a risk profile lower than most traditional narrowbody airline business models today, the essential model is second to market stability only to the CPA model. Subject to changing politics rather than changing passenger demand, airlines reliant on essential services are necessary, nonetheless.

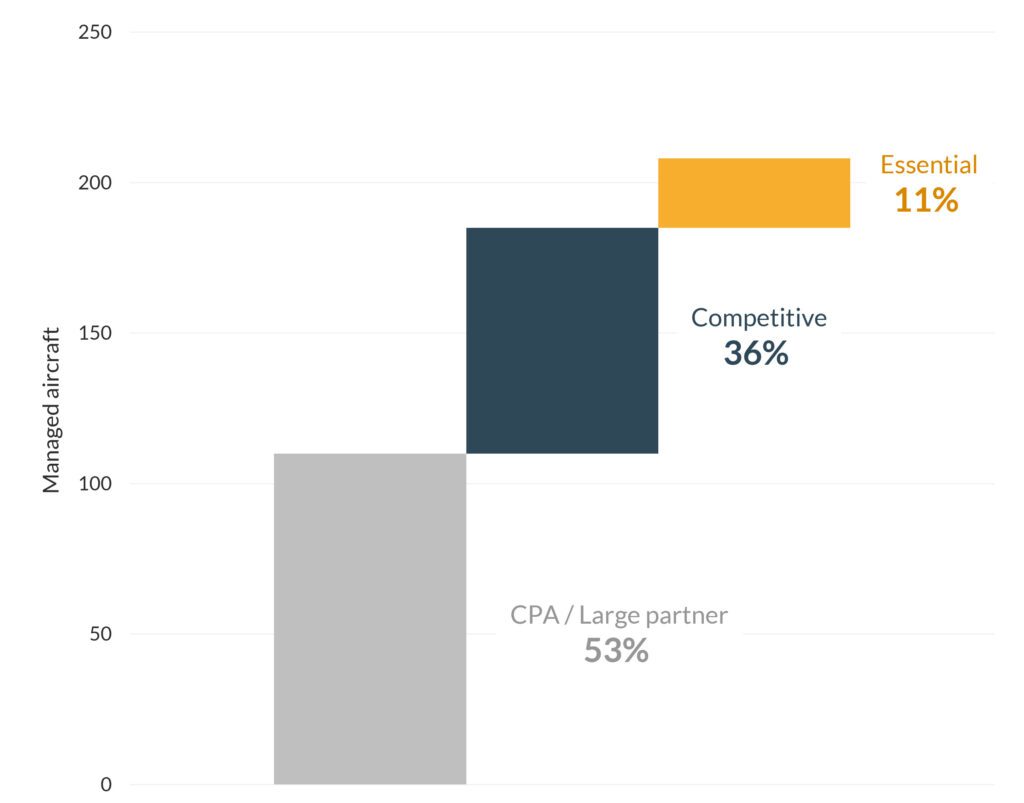

Falko’s managed fleet weighted toward low-risk regionals

(Number of aircraft managed by Falko by airline classification)

This simple categorization of the three primary regional airline business models highlights one central point: regional airlines are different from traditional commercial airlines – both in business model and risk profile.

While the aviation finance industry strives to find larger fleets to enhance returns and minimize risk, it is not often considered to turn to smaller fleets. Yet, value is often found where few are willing to explore. Due to a large proportion of the regional fleet operated by airlines with lower-risk business models, a lessor focused on regional aircraft would be much less exposed to the volatility seen in the larger commercial aircraft space.

To learn more about investing in regional aircraft contact Falko’s Investor Relations team at Investor.Relations@falko.com.